- With the debt snowball method, you pay off your smallest debt first and move on to the next-smallest debt, and then the next-smallest, and so on. During the process, you continue making the required minimum payments on all of your loans, with any extra money.

- The Debt Payoff Assistant app uses the Snowball Method to help users pay off their debt. This debt repayment method essentially involves paying off the smallest debts first, eventually working up to the largest. Minimum payments are made on your debts until the first debt is repaid.

Dec 15, 2010 ※ Debt Free App’s RESOLUTION is to help you PAY OFF YOUR DEBT. Knowing that the app does this, means that I am just looking at due dates and applying the snowball payment to the correct debt, while paying minimum payments to everything else.

This app is only available on the App Store for iOS devices.

Description

※ Top selling app in finance category

※Optimized UI for iOS11.

※Sync data across all your devices.

※ FEATURED IN WIRED MAGAZINE - “App Guide 2012”.

※ FEATURED BY APPLE IN “WHAT’S HOT”.

※ 'Debt Free makes it easy to confront Debt and manage it wisely' - 148apps.com.

※ 'Snowballs Made Easy with the Debt Free iPhone App' - Credit.com

※ Debt Free App’s RESOLUTION is to help you PAY OFF YOUR DEBT.

※ Debt Free App helps SAVE YOUR TIME and MONEY.

※ What our Customers Say ※

------------------------

※※※※※ 'Very Innovative App.By far the most well developed Debt Payoff program i have come across.'

※※※※※ 'Easy to use and practical.'

※※※※※ 'I have been using this App since an Year and i Love It! It allows you to sync between devices!'

※※※※※ 'Has been using this App from past 18 months. Nice User Interface and Perfect blend of features when compared to other similar Apps. Will recommend to my fellow FPU members .'

※※※※※ 'Have nothing but praise this App. It helped me stay focused and pay off $13,500 in 5 months. This app changed the way i viewed the money.'

Are you serious in Paying off your Debt? Then DEBT FREE App is for you.

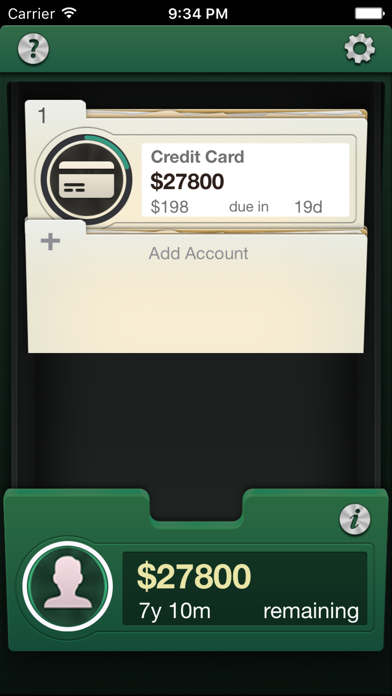

This App helps you organize,monitor and payoff your debt using debt Snowball method. You can analyze and model debt repayments to see when exactly you can become debt free. You can also Sync data between devices.

So GET STARTED ! ACHIEVE YOUR FINANCIAL FREEDOM.

※※※※

※ Bonus: This app also includes 3 Built in calculators to help you decide on monthly payments

- Payoff date calculator

- Loan calculator

- Mortgage calculator

Main Features:

※Universal Binary

- Designed for iPhone, iPod Touch, and iPad devices. No need to buy separate Apps for each device.

※Quick Debt Summary

- Displays Quick Summary of your Total Debts with Percentage Progress Bar,Debt Free Date,Interest Savings and Early Payoff Date.

※Percent Paid Progress Bars

- Percent Paid Progress Bars for each Debt which motivates you towards Paying Off your Debts.

※Reports and Charts

- 2D Pie Chart View of your Debts with Debts by Category and Debts Remaining.

※Transactions

- Enter your Expense Transactions for Each Debt so your Remaining balance will be Automatically Updated.

※Payment Due Date Notification

- You can Set Payment Due Dates Notifications and also Payment Due Date Time for Each Debt.

※Pay Off Strategies

- Supports Multiple Payoff Strategies .

- Lowest Balance

- Highest Interest Rate

- Highest Balance

- Custom Order

By choosing a strategy you can see how the Total Debt,Interest Amount and Debt Payoff date get affected.

※Tracks Multiple Debts

- You can Track unlimited Number of Debts.

※Debt Payment Tracking

- Record your Payment every time you Pay towards your Debt which automatically updates your Debts Information.

※ Promotional APR's

- Supports promotional APR's for credit cards.

※ Mortgage overhead costs

- Track mortgage payments accurately by including all over head costs.

※Amortization Table

- Amortization table shows a Complete Payment Schedule which allows you to view the interest, principal, and remaining balance for each and every payment of the Debt.

※Pay Off date Calculator

- Use the built-in Payoff Date Calculator to see the how the monthly payment amount will affect the payoff date and total interest paid.

※Extra Payment Feature

- Calculates Interest and Time Savings with Extra Payment.

※Pass Code Lock

- Pass Code Protection to keep your Financial Information Private.

※Export Capability

- Email your Debt Report and Amortization Schedule in HTML Format.

What’s New

Debt Snowball App Dave Ramsey

* iOS 11 maintenance release

* Minor bug fixes and enhancements.

Overall, it’s good for what I want

This app is super simple to use. Just enter your debt, interest rate, min payment, due date, credit limit (or original balance) and current balance. It then tells you how much total debt you have and how soon you can pay it off using the calculated plan you choose (snowball or not, highest interest, lowest balance, custom, etc). It really opened my eyes to my debt situation and gave me a clear plan...for that it deserves 5 stars.

There are a couple of issues that are mentioned in previous reviews. When you make a payment, it doesn’t credit it in the payment schedule. For example, I owed MasterCard $200 and Visa $400. Making an August payment of $200 to MasterCard and $25 to Visa, means that my September payment should be $225 to Visa. Instead it now wants me to make another August payment of $225 to the Visa. I would think that this would be an easy fix for the app designers.

Knowing that the app does this, means that I am just looking at due dates and applying the snowball payment to the correct debt, while paying minimum payments to everything else.

Great app

I’ve been trying for years now to make a snowball plan but I’ve never been able to get all the math done and actually stick to it. This app has been so much help and has kept me on track to reaching my goals! Just punch in the numbers and the app does the math and I love the figures it gives me, very detailed. If I stick to what I’m doing and keep everything going in the plan, I will save over $35,000. This is great.

The only downside of this app is that it looks... old? I really wish they could make it look prettier and more modern. The looks are the only thing keeping me from giving it a 5star review.

Debt Snowball Method App

Would be 5 stars but....

I was really excited when I got this app because of the great reviews. Initially I entered in the amount of my debt and interest rates and I played with the feature that shows what method you use to pay down your debt and how it affects your pay off time in the interest saved. Exciting! However, when I went to enter the due dates (it's currently the middle of the month) it wouldn't allow me to do anything except select a date between 1-28. There is no month function. If you are in August and that specific date hasn't occurred yet it defaults to August and there's no way to change it. I have no bills due in August. I'm paid out in a way where they're due in September and October. Now I'm trying to figure out what alarms to set in my calendar so I will be *able* to put in a correct due date and alter my balances. Unnecessary work and stress. This should be a straight forward and easy fix.

Debt Snowball Calculator

Information

Requires iOS 10.0 or later. Compatible with iPhone, iPad, and iPod touch.

Debt Snowball App Reviews

Family Sharing

With Family Sharing set up, up to six family members can use this app.

Best Overall Software: Quicken

While most debt reduction software focuses solely on helping you create a debt payoff plan, Quicken is a comprehensive personal finance software that can also help you extract more money from your monthly budget to pay off debt faster. Use the software to create a budget and track your spending so you can design a debt reduction plan based on your goals.

Quicken lets you create a debt payoff plan that prioritizes debts with the highest interest rates so you save money. You can link your accounts and allow Quicken to automatically pull your minimum payment and current interest rate, or you can manually enter the information from your monthly billing statements. As a bonus, you can also access your credit score to see how paying off your debt is helping to improve your credit. Quicken Deluxe is $29.99 per year and is available for both Windows and MacOS.